Gold lovers, rejoice! You can now purchase gold at almost half the price compared to India. While Indians have traditionally relied on countries like Dubai and Singapore for gold shopping, Bhutan is emerging as a new hotspot due to its low taxes, visa-free access, and simplified gold imports.

But is buying gold in Bhutan truly profitable? Let’s analyze the benefits, rules, and potential drawbacks.

Why Buy Gold in Bhutan?

Key Advantages:

| Factor | Benefit |

|---|---|

| Tax-Free Gold | No local tax on gold sales and low import duties make gold cheaper than in India. |

| Visa-Free Access | Indians do not require a visa to travel to Bhutan; a voter ID is enough for entry. |

| Stable Currency Exchange | Bhutan’s currency, the Ngultrum (BTN), is equal in value to the Indian Rupee (INR), ensuring no exchange rate losses. |

| Direct Sales with Fewer Middlemen | Authorized stores sell gold at competitive rates, reducing intermediary costs. |

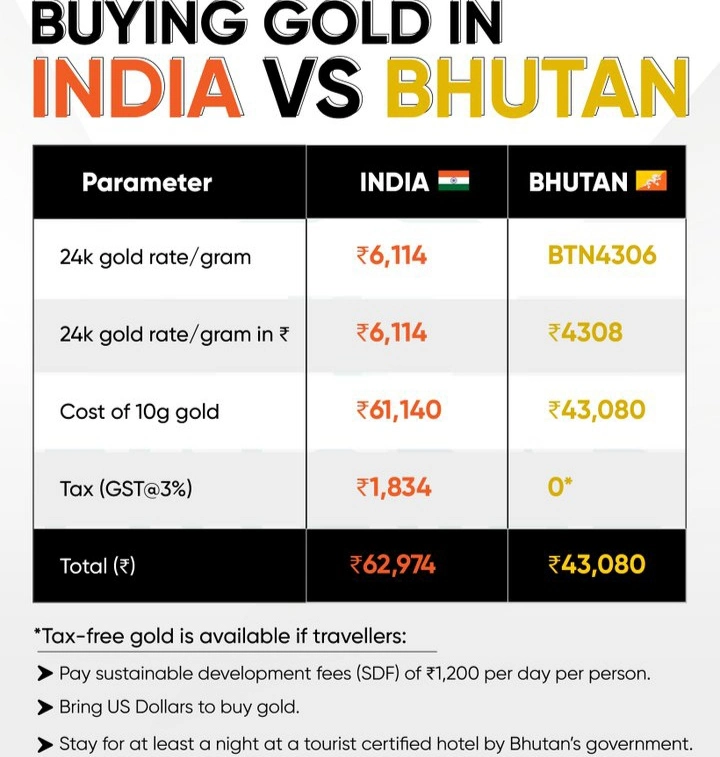

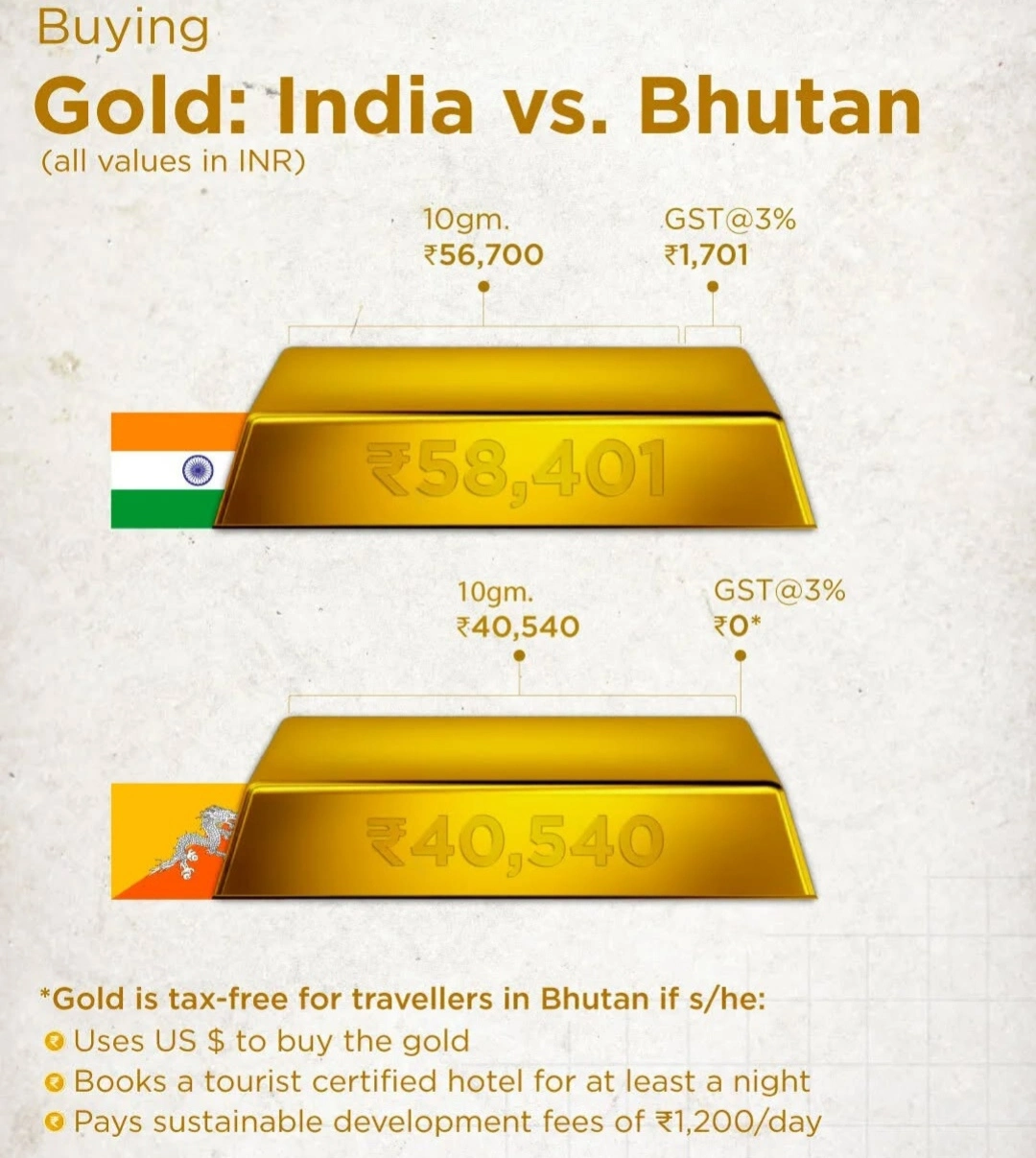

Profit & Loss Analysis of Buying Gold in Bhutan

| Factor | Profit | Loss |

|---|---|---|

| Price | 5-10% cheaper than Dubai | Travel expenses add to the cost. |

| Tax | No tax in Bhutan | 15.75% tax applies if exceeding duty-free limits when bringing gold to India. |

| Accessibility | Visa-free entry | Sustainable Development Fee (SDF) of ₹1,200-₹1,800 per day applies. |

| Currency Exchange | INR accepted with no restrictions | Gold purchase requires US Dollars. |

| Authenticity | Authorized stores offer certified gold | Risk of fake gold in unauthorized shops. |

Rules for Bringing Gold to India

As per Indian customs regulations, travelers can bring gold into India with specific limits:

| Traveler Category | Allowed Gold (Duty-Free) | Maximum Value (18K Gold) |

|---|---|---|

| Men | 20 grams | ₹50,000 |

| Women | 40 grams | ₹1,00,000 |

Tax on Excess Gold:

If gold exceeds the duty-free limit, the following taxes apply:

- Basic Customs Duty (BCD): 10.75%

- GST: 3%

- Total Tax: 15.75%

Example Calculation:

- If 24K gold costs ₹55,000 per 10 grams in Bhutan and stays within the duty-free limit, no tax is required when bringing it to India.

- However, if you carry over 40 grams, 15.75% tax will be charged.

Is Buying Gold in Bhutan Worth It?

Yes, IF:

- You buy within the duty-free limit (40g for women, 20g for men).

- You want low-cost gold with easy access.

- You prefer trusted, authorized stores for genuine quality.

No, IF:

- You are buying in large quantities (Dubai is a better option for bulk purchases due to higher purity and lower price variations).

- You don’t want to pay SDF fees and travel costs.

Final Verdict:

Buying gold in Bhutan can be a great deal for small investors or personal jewelry purchases. However, for large-scale investments, Dubai or Singapore may offer better benefits. If you’re planning a trip to Bhutan, it’s definitely worth considering gold shopping within the tax-free limits!

Stay updated on government policies and gold investment news. Join our Telegram Channel for instant alerts!