Home Loan apply online at SBI, HDFC, Axis Bank, ICICI, Bank of Baroda, Documents, How to apply

Low Interest Giving Banks for Home Loan

Everyone has their own dreams? Along with that, it is the dream of everyone to have a small or big life. In order to build this own house, the money is usually required. But now it is very expensive to build our own home in our own space. But remember that home loans has never been reduced. Loan is equipped with interest rate. But interest is true but the burden of debt is very high as we pay interest. Therefore, it is very important to borrow at low interest rates as possible.

Now banks offer you various Home Loan (Home Loan) programs with various advantages and specifications, and will give you more advantages. High qualifications, low EMIs, EMI exceptions, mixed interest rates, overdraft capacity and balance transfer capacity. Home loan is provided with all such good facilities.

These are the best banks for home loan:

Come on, then, do you give you the best home loan in 2024? If you are thinking of which bank will give, let’s find out what the bank is looking for a good bank for home loan in India.

SBI Home Loan:

Home Loan is considered the best bank for home loan in India. Home Loans (Home Loans) from State Bank of India (SBI) have some most attractive and best home loan interest rates (starting from 8.55% PA.

The choice of loan period expansion for 30 years guarantees a comfortable refund period. The process fee of these loans is 0.35 per cent of the loan amount (at least Rs. 2,000; maximum of Rs. They are one of the most popular home loan products in the country because there are no additional fees and the precursor fines are completely waived.

HDFC Home Loan:

For eligible, HDFC Home Loons (HDFC Home Loans) offers affordable home loans and interest rates start at 8.60% per year. It can be said to be another best home loan in India. For loans up to 30 years, EMI starts at Rs 762 per lakh. For employed individuals, the processing fee of these home loans does not exceed Rs 3,000. (Plus taxes applying); Unemployed persons should not exceed Rs (plus taxes applied).

Axis Bank (AXIS Bank) Home Loan:

Axis Bank Home Loan (Axis Bank Home Loan) is one of the best banks for Home Loan, interest rates start from 6.90% PA on floting-rate loan and 12% PA on fixed rated loans, AXIS Bank Eligible Consumers (Home Loan ) Provides options.

For floating rate loans, the duration can be increased to 30 years, but for stable rate loans, it can be increased to 20 years. Additionally, up to 1% of the loan amount (at least Rs. 2,500 GST (GST) should be paid in advance during the loan application login.

ICICI Home Loan:

Home Loans is available at competitive interest rates (Intrest Rate), starting from ICICI Bank to 8.60% PA. Additionally, they do not have a process fee on floating rate loans, which ranges from 0% to 0.50% of the loan (plus the applied taxes). It is considered the best bank for residential loan.

Bank of Baroda (BOB) Home Loan:

Home Loons (Home Loans) from Bank of Baroda

There are, it starts from 7.95% PA and lasts for 30 years with simple refund options. Additionally, the bank lends up to Rs 10 crore. And the Bank of Baroda residential loans have a low process cost of 0.25 percent of the loan amount. The bank does not impose any pre -term penalties for home loans with floating interest rates. The ability to become a top -up (5 Times Top Up) five times during the loan of the Bank of Baroda Home Loan was one of its main benefits

The documents required for Home Lone are as follows:

To install their KYC, the applicant will need to provide the following documents:

- Application form

- Proof of identity

- Residence

- Account statement from bank bank last six months

- Declaration of personal assets and liabilities

- Detailed property records

- Salary certificate issued by the employer

- Form 16/IT Returns

- Assessment Orders and IT Returns for the past two years.

- Proof of a business address

- Challans to confirm advance income tax payments.

For Home Loan (Home Loan) Eligibility Criteria:

A person must meet the following eligibility criteria to apply for home loan from the bank.

- Applicants must reach the minimum age of 18 years.

- The maximum age for applying for a loan is 70 years.

- Applicant’s minimum monthly income should be Rs 25,000.

- The applicant’s Cibil Score (Cibil Score) should be more than 750.

- Applicant’s employment status must be a salary or self -employed.

- One can get an LTV ratio of up to 90% from lending firms.

- Applicants can raise funds from the receipt, construction and renewal of an existing or new assets.

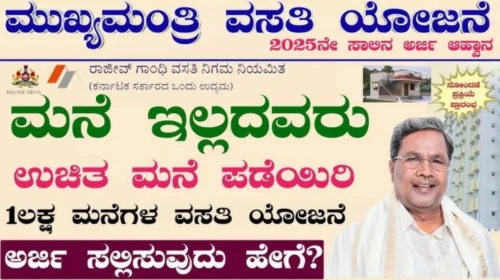

I don’t have own house