Sukanya Samriddhi Yojana What are the new rules? Sukanya Samriddhi Yojana in kannada

In January 2015, the Central Government has launched a Sukanya Samriddhi Yojana to improve the future of the country’s girls. This is a small savings scheme that is opened in the name of girls, said the government of India

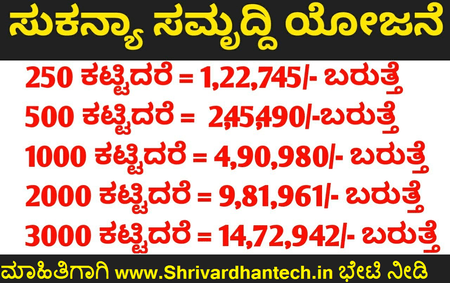

Earlier, a minimum installment of Rs.250 Reduced to 250. Under this scheme, you can invest Rs 250 to Rs 1.5 lakhs per year. This means that the account professionals can be able to keep the account for only Rs 250 to Rs 1.5 lakhs a year. Parents or legal parents can open a Sukanya Samriddhi account in the name of a girl.

How to open Sukanya Samriddhi Account?

Number of maximum accounts

Press Information Bureau (PIB) said in a statement that under the Sukanya Samriddhi Scheme, a caregiver or a parent is allowed to start two accounts in the name of a girl or a maximum of two girls. The announcement states that three daughters can be opened in the name of twin daughters or triple girls during the second childbirth.

Devaraj Arasu Loan Application 2022 Apply Online, Last Date, Application Form Loan 4% Interest

Duration of account

The account is running for 21 years from the day the account is opened. And then finish the account, the full amount of the girl who has an account is paid. If the account is not bundled even after the 21 -year maturity period, the interest will be deposited at the rate that is determined for the money in the account. If the account is married to a girl who has an account within 5 years of starting an account, the account will be completed automatically.

Maximum time of payment can be paid to the account for up to 14 years. After this period, interest is only deposited for money in the account.

What are the new rules for 2022-23?

Sukanya Samriddhi is a long-term project in which you can create your daughter’s education and bright future. You don’t need to invest more for this. There are many major changes in this project. Returning the Wrong Interest in the account under new rules has been removed. In addition, the annual interest of the account is deposited at the end of each financial year. It was before the rule that your daughter could handle the account only after 10 years. But according to the new rules, your daughter will not be allowed to maintain an account before the age of 18. Only parents continue to maintain an account.

Amount return

If a daughter who has an account is 2 years old, she is allowed to withdraw the amount in the account before the 21 -year maturity period. At the end of the previous financial year, the total amount in the account was Rs. 50 can be recovered for higher education or marriage.

Tax deduction

The Income Tax Act 1961 is a tax deduction of 80C Section and is the largest plus point of the Sukanya Samriddhi Yojana. The latest financial act has given a total of three types of tax exemption (EEE). There is a full tax exemption for all three types of money invested in the account, interest-earning interest, and withdrawal.

Pradhan Mantri Ujjwala Yojana 2022 Free Gas Connection Apply Online

When can accounts be closed?

There is an opportunity to conclude the account only on two occasions before the maturity period of the account. First, the account-owned females can conclude the account only if they die, and their parents or parents can make their claim on the amount in the account and the interest earned. The account will be deposited into the nominee’s account. Secondly, the account is allowed to be terminated only if the concerned authorities are convinced that the account professors are no longer in the situation or are becoming more and more financial to the farmers. Except for these two situations, the account cannot be terminated in other cases.

Ganga Kalyana Scheme 2022-23 Application Form, Eligibility, For Obc, Sc/St , Karnataka, Apply Online

How to open Sukanya Samriddhi Account?

Parents or legal parents can start an account in the name of the child within 10 years of birth. A girl can open a single account in the name of a girl. Parents or parents can start the Sukanya Samriddhi Account in the name of their two daughters. However, the account can be opened in the names of three children in the second childbirth or the first childbirth in the first childbirth.

Documents needed to start an account

- Application for Starting Account Form

- Birth Certificate of Female

- Identification Document (in accordance with RBI’s KYC rules)

- Proof of address (in accordance with RBI’s KYC rules)

Where can the Sukanya Samriddhi account be opened?

The Sukanya Samriddhi Project account can be opened in major bank branches or post office branches in the country. The official list of banks allocated to open an account under the Sukanya Samriddhi Scheme is as follows;

State Bank of India, State Bank of Mysore,

State Bank of Hyderabad,

State Bank of Travancore,

State Bank of Bikaner and Jaipur,

State Bank of Patiala,

Vijaya Bank,

United Bank of India,

Union Bank of India,

UCO Bank, Syndicate Bank,

Punjab National Bank, Punjab, and Sindh Bank, Oriental Bank of Commerce, Indian Overcare Bank, Indian Bank, IDBI Bank, ICICI Bank, Dena Bank, Corporation Bank, Central Bank of India, Canara Bank, Bank of Maharashtra, Bank of India, Bank of Baroda, Axis Bank, Andhra Bank, and Allahabad Bank.

Sukanya Samriddhi Account-Tax Benefits

Four major advantages will be available for subscribers. Section 80C of the Income Tax Act will be able to obtain tax exemption for investment. There is an annual cut of Rs 1.5 lakh. According to Section 10 of the Income Tax Act, the interest collected is not taxed. Tax exemption is also over the amount of finish or withdrawal.

The project will be able to get 7.6 percent interest per year. (Into effect from April 1, 2020). Interest is calculated annually. Read more about this project and how we invest Rs 411 every day and how to get Rs 60 lakh.

How to invest Rs 411 a day and earn Rs 66 lakh?

If someone invests the full Rs 1.5 lakh per year for 15 years, the investment will be finally Rs 22,500,000. This means that every day you have invested Rs 411. When the girl is 21 years old, she receives Rs 65,93,071 (Rs 22,50,000 and 43,43,071 interest).

How To Fill Sukanya Samriddhi Yojana Form Online

| New Register | CLICK HERE |

| Home More Recent Jobs Notification | CLICK HERE |

For regularly updates . Dear reader’s pleases Bookmark our website. Thank you

IF You are Satisfied By our www.shrivardhantech.in (Website) Kindly requesting Share. Sharing isCaring (Thank you for sharing ).

How much can can invest in sukanya samriddhi yojana

Generally, there is a rule that we have at least how much we should invest in all investment projects. Similarly, you can invest at least 250 rupees every day in the Sukanya samriddhi Yojana. There is also the opportunity to invest up to a maximum of Rs 1,50,000. Similarly, if any additional deposit is multiplied and multiplied by 50.